Recent market swings are causing whiplash for everyday investors. Sarah Levy, CEO of the digital investment platform Betterment, offers her advice during this volatile moment. Amid the noise around our economy, Levy extends a clear-eyed vision for how to help everyone find their own unique approach to leadership, saving, and investing.

This is an abridged transcript of an interview from Rapid Response, hosted by Robert Safian, former editor-in-chief of Fast Company. From the team behind the Masters of Scale podcast, Rapid Response features candid conversations with today’s top business leaders navigating real-time challenges. Subscribe to Rapid Response wherever you get your podcasts to ensure you never miss an episode.

The investment markets this year have been nutty so far, a booming Trump Bump followed by the so-called Trump Slump. Betterment’s clients must be concerned about this whipsawing back-and-forth, as we all are. Are there things you’re hearing from them? Are there things you’re telling them in this environment?

In large part, our advice is stay the course. It can be a good moment when markets are volatile to think about your tax strategy and tax-loss harvesting. So sometimes there are opportunities. But beyond that, we generally believe that the right long-term allocations set you up to withstand volatility.

Some of the long-term tenets about investing have been questioned a little bit of late because the market and indexes have become so concentrated in a handful of Big Tech names (Nvidia, Microsoft, Apple, Google). The indexes that maybe we’ve thought of as diversified investments may not be quite that way anymore. Do you have a philosophy about that one way or the other?

Well, I think your point is absolutely right when you’re thinking about the S&P 500, for example. And I think the point of a diversified portfolio, which incorporates international, small cap, fixed income, really is an attempt to say, “Look, when you’re having these anomalies that sometimes are short-term and sometimes are permanent corrections, if your time horizon is long-term, that should correct itself. And the right allocations should withstand the test of time.”

And that’s how we build our portfolios. But it takes steeling yourself against maybe the headlines, and the fear, and stuff that is prevalent around us. Our advice would be, don’t get sidetracked by the headlines.

President Trump seems undeterred by the falling stock market, or even the idea of a recession, though he doesn’t use the R word, right? He talks about a little pain from tariff fallouts and whatnot. Do you get what the strategy is of the administration? I’ll say that I find myself confused sometimes.

I think it is very difficult to get into the mind of the administration right now, so I wouldn’t want to prognosticate on that. I tend to focus on questions like, what are the things that directly are going to impact my business and on what time horizon? Some of this short-term stuff, I’m trying to ride it out.

Are there any new products you’re considering given the market volatility? I saw that Goldman Sachs has offered clients a stable stock list to consider in case of a recession. Nothing like a market downturn to get folks focused on risk again, right?

Well, the interesting thing for us is that we have investing and savings on the platform. And over the last couple of years, while rates have been high, introducing bond investing has been really like the next wave for us.

When there’s volatility, we see more deposits flowing into cash, that’s still paying. We have a high-yield cash account paying 4% or 4.25%. That’s still a really good principal protected return.

But we don’t have anything in particular. We’re not a shop that is asking people to check in daily on their investments because we just don’t think that breeds good behavior.

While you ran Nickelodeon as COO, the mission was what’s good for kids is good for business. I’m curious how much responsibility you think business has, particularly today, to be part of the checks and balances in American society?

That’s a perfect question for me because I’ve always been super private. I’m not big on social media. And I have always felt it was controversial. I didn’t want to speak out on everything because I’m not comfortable doing that. And because I want to separate myself personally from the brand. And coming from a founder-led organization where he really was the brand, I think speaking out with his opinion made a lot of sense because they were one and the same.

And one of the distinctions I wanted to make, and it was controversial with the employees more so than anything else, was they wanted to hear from me.

And I said, “Look, if it impacts the business, I’ll talk about it loud and proud. But if it’s not about the business, we serve customers with different viewpoints, and my perspective is, we need to be a platform that offers choice.”

And so, if that choice includes crypto, for those who like it, great. And for those who don’t want it, also great. Same with socially responsible investing portfolios. We have a climate portfolio. There are people who love that, and there are people who want nothing to do with it. Great. Nobody is asking you to opt in or to opt out. We’re giving you a choice so that you can pave your own way.

And when at Nickelodeon you said, “What’s good for kids is good for business,” you meant, “What’s good for kids right now,” as opposed to what might be good for them in the future.

That was when we started the early days of Nickelodeon, and we did a lot of research around preschool content, for example. We always wanted to enrich the content with good lessons. There was always a lot of educational underpinning and educators helping us with it.

We were not trying to just sell kids a toy. Now, what ended up happening is if they fell in love with those characters, and they learned to count, then maybe they’d want to buy the toy that counted with them there. So hence, why it was good for business to basically do the right thing.

Now we talk about “eating your vegetables” versus “eating candy.”

Taking Robinhood as an example, I think they’re serving you a piece of cake, and then you wake up the next day, you’re like, “Oh, I really need a diet.”

We’re saying, “Eat your vegetables, have some spinach.” You may be choking it down, but you feel pretty good the next day.

So what’s at stake for everyday investors right now? How should they think about the role of their portfolio in their lives, in their personal values, in their future?

What we always tell people is, “Think about your money.” Which is to say, “Okay, you should always have an emergency savings account that is three to six months relatively liquid assets,” so that if you get in a bind, which happens on a lot of occasions, that’s there for you. That’s an early first principles recommendation that our folks make.

Think about retirement early. Take advantage of whether it’s an IRA, a Roth versus a traditional. There are different rules depending on where you are in your life journey, and where your income is, and where you can really get great advantages from government policies, in terms of tax advantages.

To me, at the end of the day, be invested with whatever you can. Start early. And in these worlds, and this time of uncertainty, people with advisers do better because they have someone they can call who they trust, who prevents them from making mistakes.

We believe deeply that human and digital go hand in hand and everyone should choose how much of each they want and they’re comfortable with.

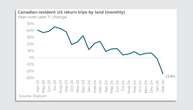

No comments